Understanding the Average Cost of Dental Insurance: A Patient's Guide

This article will help you understand the average cost of dental insurance. We'll explore what factors influence the cost of dental insurance, how different dental plans work, and whether individual dental insurance is right for you. Knowing this information can help you make informed decisions about your oral health and budget, ensuring you receive the best possible dental care. ISTAR Dental Supply is a dental product manufacturer, and while we don't sell insurance, we understand the importance of making informed decisions about your dental health.

What is the Average Cost of Dental Insurance?

The average cost of dental insurance isn't a single, fixed number. It depends on several factors. Think of it like buying a car – a basic model costs less than a luxury car with all the extras. Similarly, a basic dental plan will have a lower monthly premium than a comprehensive plan covering major procedures. Generally, you can expect individual dental insurance premiums to range from $25 to $60 per month, or $300 to $700 per year. Family dental plans will cost more, potentially $50 to $150 or more per month.

Remember that employer-sponsored group dental plans are often cheaper because the employer shares the cost. If you have access to a group plan through your job, it's usually a more affordable option than individual dental coverage.

What are the Different Types of Dental Insurance Plans?

Just like there are different types of cars, there are different types of dental insurance. Here's a summary of the common ones:

- Dental Preferred Provider Organization (DPPO): A DPPO gives you a list of dentists (a "network") who have agreed to charge lower fees. You can see a dentist outside this network, but you'll likely pay more out-of-pocket.

- Dental Health Maintenance Organization (DHMO): With a DHMO, you choose a primary dentist from the network. They manage your care and refer you to specialists if needed. You generally can't see out-of-network dentists except in emergencies. DHMOs often have lower premiums but less choice.

- Dental Indemnity Plans: These are like "choose any doctor" plans. You can see any dentist, and the insurance plan pays a set percentage of the cost. You pay the rest. These offer the most freedom but often have higher premiums.

- Dental Exclusive Provider Organization (DEPO): Similar to a DPPO and DHMO. You need to use dentists who are in the network.

Here's a table summarizing the key differences:

| Feature | DPPO (Dental Preferred Provider Organization) | DHMO (Dental Health Maintenance Organization) | Dental Indemnity | DEPO (Dental Exclusive Provider Organization) |

|---|---|---|---|---|

| Network | Network of dentists with negotiated rates | Network of dentists; must choose a primary care dentist | No network; can see any dentist | Network of dentists; must see in-network dentists |

| Out-of-Network | Covered, but at higher cost | Usually not covered, except in emergencies | Fully covered | Not covered, except in emergencies |

| Premiums | Typically moderate | Typically lower | Typically higher | Moderate |

| Flexibility | High; can see specialists without referral | Low; requires referrals for specialists | Highest; can see any dentist without a referral | Low; must use network dentists |

| Out-of-Pocket Costs | Lower in-network, higher out-of-network | Generally lower, but limited to network providers | Higher, but freedom to choose any dentist | Generally lower, but limited to network providers |

| Referrals | Not required. | Required for specialist. | Not required. | Required. |

ISTAR Dental Supply, a trusted dental supply manufacturer, recognizes the importance of educating dental patients about these various plans.

How Do Deductibles, Coinsurance, and Annual Maximums Work?

These three terms are important for understanding how much you'll actually pay for dental care:

- Deductible: This is the amount you pay for dental services before your insurance starts to pay. For example, if you have a $100 deductible, you'll pay the first $100 of your dental bills.

- Coinsurance: After you've met your deductible, coinsurance is the percentage of the remaining cost that you pay. A common split is 80/20 – the insurance will pay 80%, and you pay 20%.

- Annual Maximum: This is the most your insurance plan will pay for your dental care in a year. Once you hit this limit, you're responsible for all further costs.

Let's say you have a procedure that costs $500. You have a $100 deductible and 80/20 coinsurance.

- You pay the first $100 (deductible).

- The remaining cost is $400.

- The insurance pays 80% of $400, which is $320.

- You pay 20% of $400, which is $80.

- Your total cost: $100 (deductible) + $80 (coinsurance) = $180.

Why is Preventive Care Usually Covered So Well?

Most dental insurance plans cover preventive care – like cleanings, check-ups, and X-rays – at 100%. This means you often pay nothing for these services. Why? Because catching problems early is cheaper than treating them later! Regular check-ups can prevent cavities from becoming root canals, saving both you and the insurance company money in the long run. Regular use of products such as an Ultrasonic Scaler, in the dental office, are important.

What Dental Procedures are Commonly Included in Insurance Plans?

Most dental insurance policies divide procedures into three groups:

- Preventive: Exams, cleanings, X-rays (often covered at 100%).

- Basic: Fillings, extractions, and sometimes root canals (you'll usually pay coinsurance, like 20-30%).

- Major: Crowns, bridges, dentures, and oral surgery (you'll likely pay a higher coinsurance, like 50%).

It is very important to note that some plans have waiting periods before they'll cover major procedures.

In-Network vs. Out-of-Network Dentists: What's the Difference?

- In-Network Dentists: These dentists have a contract with your insurance company to charge lower fees. You'll usually pay less when you see an in-network dentist.

- Out-of-Network Dentists: You can usually see them, but you'll likely pay a higher percentage of the cost. With a DHMO, you typically can't see out-of-network dentists except in emergencies.

It is always a good idea to check if your preferred dentist is in your insurance plan's network before you make an appointment.

What are Dental Savings Plans (and are they Insurance)?

Dental savings plans (or dental discount plans) are not insurance. They're like a membership club. You pay an annual fee and get access to a network of dentists who offer discounted rates. There are no deductibles, copays, or annual maximums.

These plans can be a good option if you don't have dental coverage or if you need a lot of dental work that would exceed your insurance's annual maximum. But they don't offer the same financial protection as real insurance. A good range of dental equipment, such as Dental Handpiece is always beneficial.

Is Dental Insurance Worth the Cost?

This depends on your individual needs. If you only need regular check-ups and cleanings, you might pay less out-of-pocket without insurance. But if you think you might need fillings, crowns, or other major dental care, insurance can save you a significant amount of money.

Think of it like car insurance – you hope you won't need it, but it's there to protect you from big, unexpected expenses.

How to Choose the Right Dental Plan for You

Here are some things to consider when choosing a dental plan:

- Your Budget: How much can you afford for a monthly premium?

- Your Oral Health: Do you generally have healthy teeth, or do you often need dental work?

- Your Dentist: Is your preferred dentist in any insurance networks?

- The Plan's Details: Carefully read the plan's coverage, including deductibles, coinsurance, annual maximums, and any waiting periods.

Frequently Asked Questions About Dental Insurance

-

What if I can't afford dental care, even with insurance?

- Talk to your dentist's office. They may offer payment plans or financing options.

- Look into community dental clinics or dental schools, which may offer lower-cost care.

-

How do I find out what my insurance covers?

- Read your plan documents carefully.

- Call your insurance company and ask.

- Ask your dentist's office to help you understand your benefits.

-

What's a "copay"?

- A fixed fee payed for a specific service.

-

Do all dental plans cover braces?

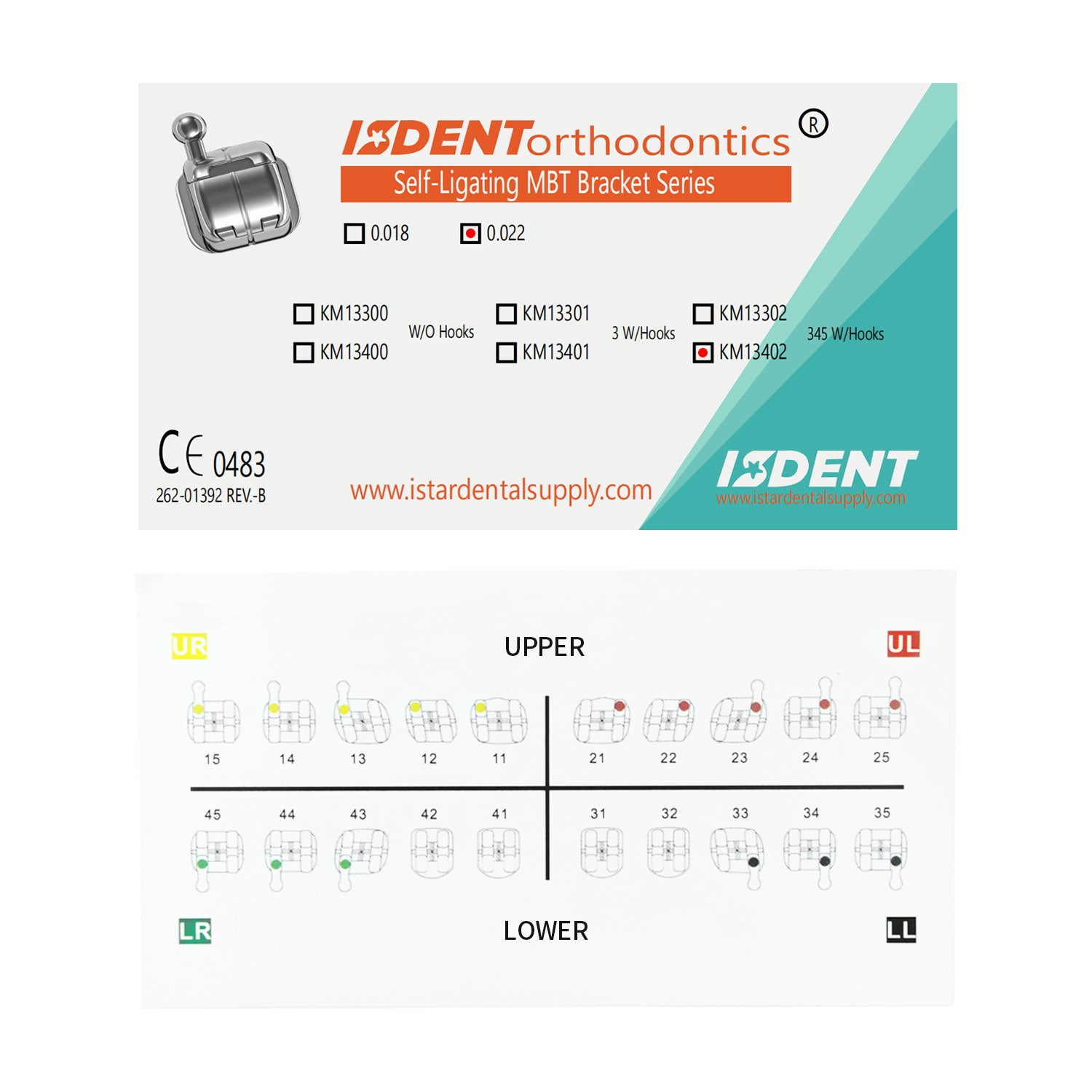

- Not all plans cover orthodontic treatment (braces). If they do, it's often limited to children and has a separate lifetime maximum. ISTAR offers great quality Orthodontics supplies.

-

What's a "waiting period"?

- A period of time you need to be on the dental insurance plan, before certain procedures are covered.

-

Are x-rays and scans covered by insurance?

- Yes, and ISTAR has excellent Dental X Ray machines and Dental RVG Sensor.

Key Takeaways

- The average cost of dental insurance varies widely.

- Understand the different types of dental plans (DPPO, DHMO, Indemnity) to choose the best one for you.

- Pay attention to deductibles, coinsurance, and annual maximums – they affect how much you'll pay.

- Preventive care is usually covered at 100% – take advantage of it!

- Dental insurance can be a valuable investment, especially if you anticipate needing more than just routine care.

- Be sure to also check out ISTAR's range of Dental Equipment.

ISTAR Dental Supply is dedicated to providing high-quality dental products to dental professionals. We hope this guide helps you navigate the world of dental insurance and make informed choices about your oral health. We want to help you find the best value in dental care. content_copy download Use code with caution. Markdown